The U.S. economy continued to grow in December. That's the message from the incoming numbers for last month, echoing the analysis from our previous update a month ago. Although several key reports for December are still missing, the numbers published so far suggest that the economy ended 2012 on an upbeat note. Anything's possible, of course, when it comes to yet-to-be published and revised indicators. But the early analysis of the December economic profile tells us that the odds remain low that the end of last year will mark the start of a new recession.

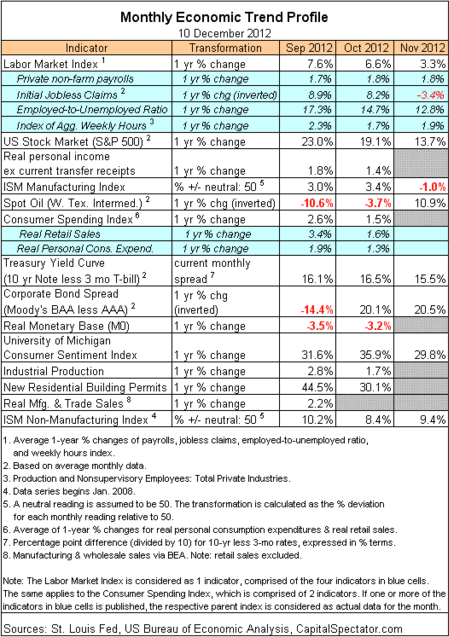

Let's dig into the data for some perspective on how the broad trend looks at this point. In the table below, eight of 14 indicators in The Capital Spectator Economic Trend Index (CS-ETI) published for December are trending positive.

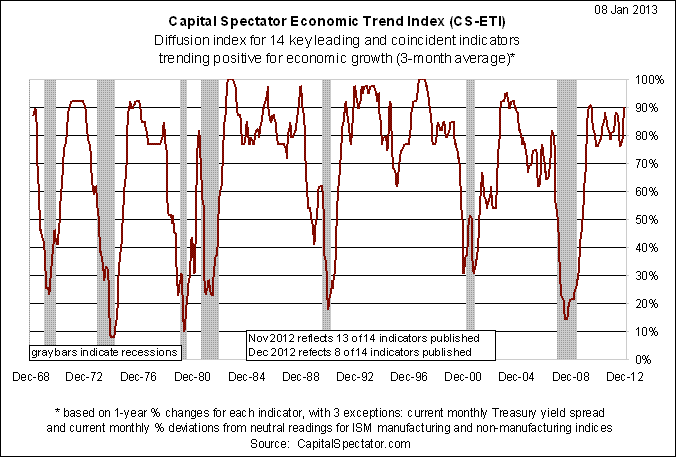

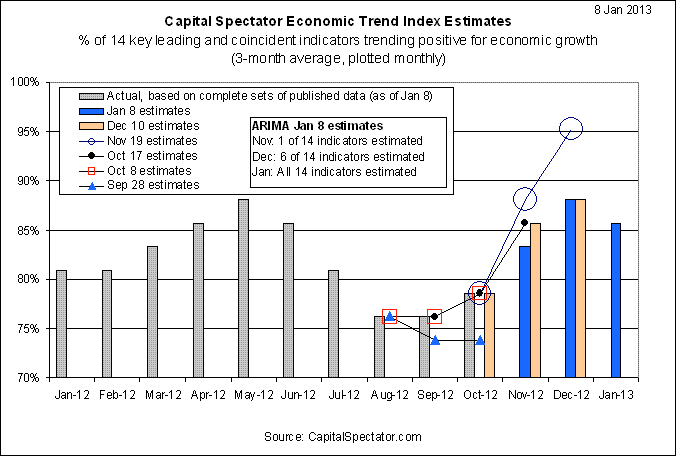

Here's how the 14 indicators stack up on an historical basis as tracked by a diffusion index, aka CS-ETI, which measures the share of this data set that's trending positive in terms of a three-month rolling average. With readings in the 75%-to-90% range in recent months, the odds of a new recession appear low. What would change the analysis? If CS-ETI falls below 60%, which would constitute a warning that the trend is weakening. A drop under 50% would be a virtual certainty that the business cycle has crashed. The good news is that we're nowhere near those tipping points.

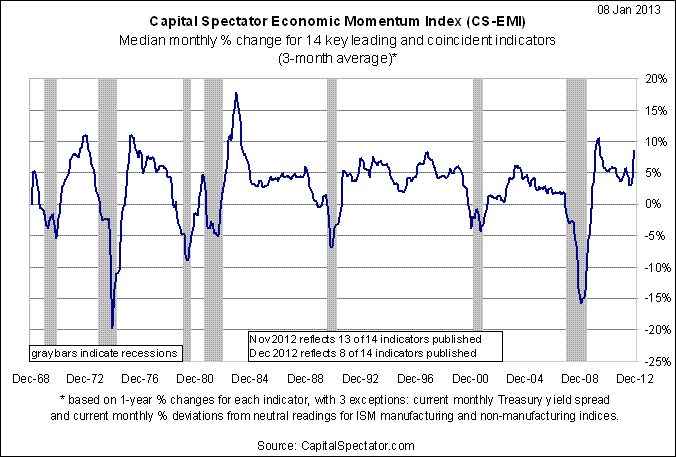

For another perspective on the 14 indicators in the table above, let's consider another measure of the business cycle: The Capital Spectator Economic Momentum Index (CS-EMI), which was introduced last month. The basic idea here is to measure the median percentage change in the 14 indicators for another perspective on the business cycle. Here's how CS-EMI compares through history on a three-month rolling basis. As you can see, the readings for this indicator are also favorable for arguing that growth still has the upper hand.

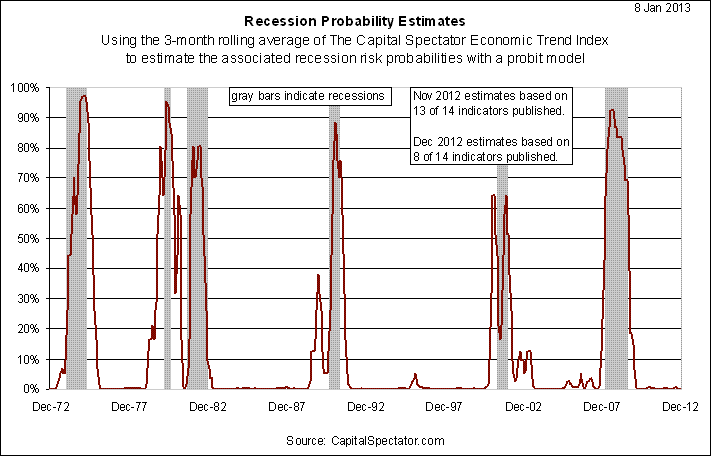

Returning to CS-ETI, here's how this macro benchmark compares when we convert the underlying data into recession-risk probabilities via a probit model. Here too the numbers suggest that another downturn is a low-probability event through December. Analyzing its index counterpart--CS-EMI -- in terms of a probit model tells a similar story.

Finally, let's model the near-term outlook by estimating the next several monthly values for CS-ETI's three month averages. I generated forecasts for each of CS-ETI's indicators, independently, using an ARIMA model via the "forecast" package in R. Next, I aggregated the results to estimate CS-ETI for the next several months by filling in the missing numbers for each of the monthly data sets. It's safe to assume that a fair amount of error infects any one forecast, although aggregating the individual estimates can minimize the risk a bit if some of the errors cancel each other out. For some context, the chart below tracks earlier estimates and compares them with the actual values that were reported later. As you can see, the estimates so far have been useful for developing some intuition about where CS-ETI is headed. Looking ahead still suffers all the usual caveats, but the current outlook suggests that CS-ETI's readings will remain comfortably on the side of growth.

Overall, the numbers tell us that recession risk appears low through December, based on the latest economic reports. That's no guarantee that the updates in the weeks ahead won't bring darker news. But if the economy is set to deteriorate, the signals will be conspicuous as new data arrives and previously published numbers are revised downward. For now, however, the outlook remains relatively encouraging for anticipating that the economy will continue forge ahead with a modest growth trend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Economic Profile | 1.08.13

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.